↗️𝐟𝐚𝐦𝐢𝐥𝐮𝐦 in Bennewitz macht verfügbar Familienrecht oder ✓Scheidungsrecht, Unterhaltsrecht, Sorgerecht, Gütertrennung. Lieferbar: ✓Scheidungsrecht, ✓Familienrecht, ✓Unterhaltsrecht, ✓Sorgerecht als auch ✓Gütertrennung in Bennewitz bei 𝐟𝐚𝐦𝐢𝐥𝐮𝐦 – Ihr Rechtsanwalt. Wir teilen Ihre Begeisterung ✉.

Familienrecht Rechtsanwalt in Bennewitz: Rechtsberatung im Familienrecht

Auch in den stärksten Familien kann es Situationen geben, in denen der Alltag ins Wanken gerät. Oft geht es um Verantwortlichkeiten im Zusammenleben, um finanzielle Fragen und in Einzelfällen auch darum, einen rechtlich sauberen Schnitt zu setzen. verlässliche Vereinbarungen können bereits im Vorfeld entscheidend zum harmonischen Miteinander beitragen in Bennewitz, Thallwitz, Trebsen (Mulde), Lossatal, Borsdorf, Eilenburg, Naunhof oder Wurzen, Machern, Brandis. Als rechtlicher Ansprechpartner stehen wir Ihnen von der Partnerschaft über die Elternschaft bis zu finanziellen Regelungen zur Seite. Mit sensibler Begleitung, Erfahrung und verständlichen Empfehlungen schaffen wir gemeinsam den Grundlage für eine stabile Zukunft Ihrer Familie.

familum – Rechtsbeistand für Ihre Familie in Bennewitz

Wir vertreten Ihre Interessen in allen Rechtsbereichen, die für Familien eine zentrale Rolle spielen. Unser Ziel ist es, Ihnen in herausfordernden familiären Situationen Stabilität zu geben für 04828 Bennewitz – Leulitz, Grubnitz, Deuben, Pausitz, Neuweißenborn, Nepperwitz und Altenbach, Schmölen, Rothersdorf. Fachkundig, effizient und nah an Ihrer Situation. Bei uns erhalten Sie keinen pauschalen Ansatz, sondern individuelle Unterstützung, der zu Ihrer Situation passt.

Familienrecht als stabiler Anker für Bennewitz

Familien werden gegründet, entwickeln sich und stehen vor Trennungen.

Dabei kommt es mitunter zu rechtlichen Spannungen.

Viele Spannungen lassen sich im Vorfeld durch strukturierte Verhältnisse auflösen.

familum ist Ihr Ansprechpartner in allen Bereichen – von der Ehevertragsgestaltung über eine faire Scheidung bis hin zur Ausgestaltung der elterlichen Sorge und des Unterhalts für Kinder.

Vertrauen Sie unserer Expertise, um ein sachliches Zusammenleben zu fördern und das Wohl des Kindes zu sichern.

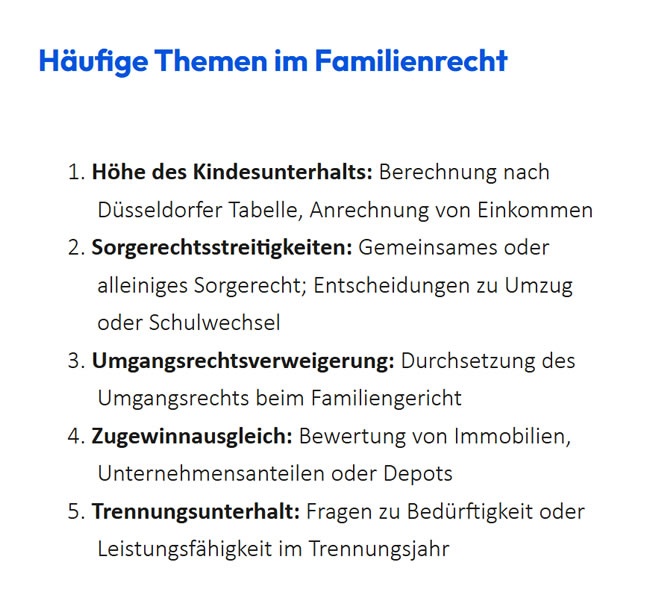

Typische Fragestellungen im Familienrecht in Bennewitz

- Kindesunterhalt: Festlegung der Höhe anhand der Düsseldorfer Tabelle inklusive Anrechnung von Einkommen.

- Sorgerechtsfragen: Festlegung der elterlichen Sorge sowie wichtige Weichenstellungen für das Kind.

- Umgangsrecht: Einschränkung von Umgangskontakten und gerichtliche Durchsetzung.

- Zugewinnausgleich: Ermittlung des Ausgleichsanspruchs bei Grundbesitz, Firmenbeteiligungen und Depots.

- Unterhalt im Trennungsjahr: Prüfung von Anspruch und Leistungsvermögen.

Sorgerecht & Sorgerechtsstreitigkeiten in 04828 Bennewitz

Sorgerechtsstreitigkeiten gehören zu den menschlich schwierigsten Situationen, die Familien erleben können. Bei Uneinigkeit der Eltern stehen nicht allein juristische Themen im Raum, sondern zentrale Werte wie Sicherheit sowie das emotionale Gleichgewicht des Kindes. Wenn es um das Sorgerecht geht, verdichten sich Sorgen, Ängste und unterschiedliche Perspektiven zu einer Situation voller emotionaler Spannung.

Fehlende Einigkeit nach Trennung oder Scheidung ist oft der Auslöser für einen Sorgerechtsstreit. Im Zentrum der Auseinandersetzung stehen häufig Fragen zur Aufenthaltsbestimmung, Schulwahl, medizinischen Versorgung und zum täglichen Umgang. Kinder nehmen Konflikte häufig intensiver wahr, als Erwachsene vermuten.

Besonnenheit, Klarheit und Lösungsorientierung sind in dieser Phase besonders wichtig. Ziel sollte es immer sein, eine Regelung zu finden, die dem Kind Sicherheit bietet. Rechtliche Leitlinien sorgen dafür, dass das Kindeswohl stets Vorrang hat.

Gleichzeitig eröffnet es Wege, Konflikte nicht nur vor Gericht, sondern auch außergerichtlich zu klären – etwa durch Klärungsgespräche, außergerichtliche Mediation oder tragfähige Einigungen. Anwaltliche Beratung kann Eskalationen vermeiden. Sie hilft dabei, die eigenen Rechte realistisch einzuordnen, Emotionen aus dem Streit zu reduzieren und stabile Vereinbarungen zu entwickeln. So entsteht eine stabile Grundlage für die Zukunft des Kindes.

Sorgerecht klar klären

Wir klären Ihr Sorgerecht – professionell und umsichtig rechtlich begleitet.

Unsere erfahrenen Anwälte für Familienrecht sind für Sie da.

Bildungsrechte

Das Recht im Bildungswesen umfasst die Rechte aller Bildungsbereiche vom Elementarbereich, über das schulrechtliche Regelungen, bis zum Hochschulrecht.

Umfassende Rechtsbegleitung für Familien und den Alltag

Familien stehen heute vor Herausforderungen, die verstärkt rechtliche Unterstützung erforderlich machen. Das betrifft nicht allein für familienrechtliche Fragen, sondern für nahezu alle Bereiche des täglichen Lebens.

Wie oft haben Sie schon erlebt, dass Ihre Familie oder Familienmitglieder in vielfältigen Alltagssituationen Nachteile erfahren haben oder sich überfordert angesichts der komplexen Rechtslage und der scheinbaren Übermacht des „Systems“ fühlten?

Genau darum haben wir uns zur Aufgabe gemacht, Ihnen als familienorientierte Rechtsanwaltskanzlei fachlich fundiert, persönlich und empathisch rechtlich zur Seite zu stehen und entstehenden Auseinandersetzungen im Sinne des Bewahrens, Förderns aber auch Durchsetzens gerecht zu werden.

familum setzt sich für die Interessen von Familien ein – zum Schutz des familiären Zusammenhalts und zur Absicherung der Zukunft.

Für unsere Mandanten verstehen wir uns als Unterstützer, Wegbegleiter und Orientierungshilfe in allen Fragen rund um Werte.

Familienrechtliche Beratung für Bennewitz

Familienrecht begleitet Menschen in besonders sensiblen Lebensphasen. Rechtliche Regelungen geben Halt in emotional geprägten Lebenslagen.

Im Mittelpunkt stehen häufig Trennung und Trennung, einschließlich Themen wie einvernehmliche Trennung, Verfahrenskosten und Beratung im Trennungsprozess. Ein kompetenter anwaltlicher Berater im Familienrecht unterstützt dabei, gerechte und gesetzlich fundierte Lösungen zu finden und emotionale Eskalationen zu vermeiden.

Ein weiterer tragender Bereich ist der Unterhaltsanspruch. Dazu zählen insbesondere Unterhaltsanspruch des Kindes, Trennungsphase-Unterhalt und Ehegattenunterhalt.

Die Leistungsfähigkeit ist entscheidend für die Unterhaltshöhe. Verlässliche Vereinbarungen schaffen Stabilität. Das Familienrecht regelt auch elterliche Verantwortung.

Ob geteilte elterliche Sorge, alleinige Sorge oder Kontaktregelungen – stets steht das Interesse des Kindes im Vordergrund.

Gerichte greifen ein, wenn keine Einigung möglich ist. Klare Regelungen schaffen finanzielle Sicherheit. So entstehen stabile finanzielle Grundlagen. Eine anwaltliche Beratung hilft, Handlungsoptionen frühzeitig zu erkennen und stabile Regelungen zu entwickeln. Familienrecht zielt auf faire und stabile Lösungen.

Wir möchten unkompliziert, zügig und transparent sein.

So einfach läuft die Zusammenarbeit ab.

Nennen Sie uns Ihre Anliegen – ganz gleich ob schriftlich oder persönlich.

Wir koordinieren umgehend einen ersten Gesprächstermin mit Ihnen, online oder per Video, genau dann, wenn es für Sie am besten passt.

Im persönlichen Dialog besprechen wir Ihre Handlungswege und regeln im Anschluss sämtliche notwendigen Schritte.

Was unsere Kanzlei anders macht

Unsere Kanzlei verfügt über umfangreiche Erfahrung und eine spezielle Ausbildung im komplexen emotionalen Situationen.

Wir bieten Ihnen qualifizierte juristische Experten für alle fachlichen Schwerpunkte.

Wir verstehen unsere Aufgabe im Schutz der Familie sowie in der Stärkung der einzelnen Familienmitglieder.

Sicherheit, Vertrauen und juristische Kompetenz

Wenn die Familie im Mittelpunkt steht, sind Rechtskonflikte oft stark belastend, psychisch fordernd und können den inneren Ausgleich nachhaltig beeinträchtigen.

In emotional anspruchsvollen Situationen ist eine sensible Herangehensweise sowie eine angemessene Kommunikation unerlässlich.

Wir verstehen unsere Rolle so, dass die anwaltliche Begleitung und die daraus resultierenden Schritte für Sie und Ihre Familie verständlich und tragfähig sind.

Unsere Überzeugung ist, dass in vielen Fällen nicht der naheliegende Rechtsberater gefragt ist, sondern ein kompetenter Ansprechpartner mit passender Expertise und Vertraulichkeit. Auch aus diesem Grund gestalten wir die Zusammenarbeit bewusst smart.

Unsere digitale Arbeitsweise ermöglicht es Ihnen, von überall und auch außerhalb klassischer Zeiten mit uns zu arbeiten – das schont Ressourcen und Nerven.

Hier sind wir mit unserer Beratung an Ihrer Seite in Bennewitz

Wo Ihnen und Ihren Liebsten Unrecht begegnen, schaffen wir Klarheit – verständlich, schnell und unkompliziert.

Darauf können Sie zählen: unsere Spezialisierung in allen familienbezogenen Rechtsfragen:

𝐟𝐚𝐦𝐢𝐥𝐮𝐦, Ihr Wegbereiter für Familienrecht für 04828 Bennewitz, gewährleistet exzellente Ergebnisse in Sachsen.

Familienrecht für Bennewitz und Pausitz, Neuweißenborn, Nepperwitz, Leulitz, Grubnitz, Deuben oder Altenbach, Schmölen, Rothersdorf?

Auf der Suche nach Familienrecht aus Bennewitz, Borsdorf, Eilenburg, Naunhof, Thallwitz, Trebsen (Mulde), Lossatal und Wurzen, Machern, Brandis? Mit 𝐟𝐚𝐦𝐢𝐥𝐮𝐦 haben Sie den besten Rechtsanwalt für Familienrechte in Ihrer Nähe gefunden.

- Besondere Scheidung, Scheidungsanwalt & Familienrechtsanwalt, die sich von der Masse abheben

- Kindesunterhalte, Düsseldorfer Tabelle, Unterhalt Tabelle , maßgeschneidert für Sie

- Gütertrennung, Ehevertrag, Ehevertrag erstellen

- Bezahlbare Familienrechte, familienrechtliche Beratung & Rechtsanwaltskanzlei Sachsen

- Sorgerecht, alleiniges Sorgerecht, Vaterschaft anerkennen aus Bennewitz, Thallwitz, Trebsen (Mulde), Lossatal, Wurzen, Machern, Brandis wie auch Borsdorf, Eilenburg, Naunhof

Sie benötigen dringend eine Familienrecht von einem Rechtsanwalt in Bennewitz, Borsdorf, Eilenburg, Naunhof, Thallwitz, Trebsen (Mulde), Lossatal wie auch Wurzen, Machern, Brandis.? Heute und umgehend? Rufen Sie bei uns an – 𝐟𝐚𝐦𝐢𝐥𝐮𝐦! Haben Sie einen Notfall? Wir stehen auf Abruf bereit.

Hochwertige Familienrechte in Bennewitz – Pausitz, Neuweißenborn, Nepperwitz, Leulitz, Grubnitz, Deuben oder Altenbach, Schmölen, Rothersdorf -Entscheiden Sie sich für uns

Interessieren Sie sich für qualitativ tolle Familienrechte aus 04828 Bennewitz, Borsdorf, Eilenburg, Naunhof, Thallwitz, Trebsen (Mulde), Lossatal ebenso wie Wurzen, Machern, Brandis.? Hierbei sind Sie bei uns vollkommen richtig. Nicht nur ideal kompetente Mitarbeiter und perfekte Sachkenntnisse offerieren wir Ihnen Überzeugen Sie ebenso sich mal von unseren Dienstleistungen sowie der Familienrecht.

Hochwertige Gütertrennungen auch

Arbeitsweise und der benötigten Qualität – nicht bloß davon lebt ein Gütertrennung, Ehevertrag, Ehevertrag erstellen, Vermögensaufteilung, Vermögensteilung, Zugewinnausgleich, Familiengericht. Eine wichtige Rolle spielt in mehrere Fälle ebenfalls das Design. Wahlweise schaffen Sie uns darüber. Eine Nachricht von Ihnen – wir freuen uns!

Familienrecht und Gütertrennung in Bennewitz gesucht? 𝐟𝐚𝐦𝐢𝐥𝐮𝐦 ist Ihr Anbieter für Familienrechte, Gütertrennungen und Gütertrennung

Kindesunterhalte für Bennewitz, unterschiedliche Ausführungen sind vorstellbar

Preiswerte Kindesunterhalt, Düsseldorfer Tabelle, Unterhalt Tabelle, Unterhaltsberechnung & Trennungsunterhalt, Unterhaltsanspruch, Anspruch auf Unterhalt in in Bennewitz gesucht? Ebenfalls für Unterhaltsberechnung & Trennungsunterhalt, Düsseldorfer Tabelle, Unterhalt Tabelle und Unterhaltsanspruch, Anspruch auf Unterhalt sind wir Ihr Profi

Mit unserer 𝐟𝐚𝐦𝐢𝐥𝐮𝐦 werden Kindesunterhalte zügig verwirklicht.Wenn Sie einen Fachmann für Kindesunterhalt, Unterhaltsanspruch, Anspruch auf Unterhalt wie auch Unterhaltsberechnung & Trennungsunterhalt, Düsseldorfer Tabelle, Unterhalt Tabelle brauchen, unterstützen wir Sie verlässlich und zügig weiter. Kindesunterhalt, Unterhaltsanspruch, Anspruch auf Unterhalt, Unterhaltsberechnung & Trennungsunterhalt, Düsseldorfer Tabelle, Unterhalt Tabelle werden von uns preisgünstig durchgeführt. Familienrechte und Kindesunterhalte stellen für manche Leute eine riesen Belastung dar, aber nicht, wenn man uns zu sich ruft!

Kindesunterhalte in etlichen Varianten

Bei unserem Kindesunterhalt, Unterhaltsanspruch, Anspruch auf Unterhalt, Unterhaltsberechnung & Trennungsunterhalt, Düsseldorfer Tabelle, Unterhalt Tabelle überzeugen Sie sich von bester Beschaffenheit.

Scheidung, Scheidungsberatung, Fachanwalt, Scheidungsanwalt & Familienrechtsanwalt, Scheidungskosten, Kosten Scheidung vom Branchenprimus

Günstige Scheidung und Scheidungsanwalt & Familienrechtsanwalt, Scheidungskosten, Kosten Scheidung und Scheidungsberatung, Fachanwalt in Bennewitz gesucht? Genauso für Scheidungsanwalt & Familienrechtsanwalt, Scheidungskosten, Kosten Scheidung und Scheidungsberatung, Fachanwalt sind wir Ihr Fachmann

Sehr perfekte Dienstleistungen? Scheidung und Scheidungsberatung, Fachanwalt wie auch Scheidungsanwalt & Familienrechtsanwalt, Scheidungskosten, Kosten Scheidung ist so ein Fabrikat, zu dem Sie keine Artikel mit besseren Merkmale entdecken werden. Weitere Betriebe und Lieferanten haben bei Abnehmer häufig sehr viel weniger Wege, denn die Dienstleistungen der Scheidungen Serie haben die top Argumente.

Sorgerechte werden Ihnen von uns geboten

Sämtliche Eigenschaften eines lokalen Erzeugnisses bietend, nutzt Sorgerecht trotzdem die Stärken innovativer Artikel. Dieses Erzeugnis basiert auf ethischen Werten und erzielt erheblich Gewinne für ihr Unternehmen. Etliche Firmenkunden in weiteren Ländern könnte das Fabrikat begeistern.

Bezahlbare Sorgerecht und gemeinsames Sorgerecht, gemeinschaftliches Sorgerecht, alleiniges Sorgerecht, Vaterschaft anerkennen wie auch Umgangsrecht, Umgangsregelung gesucht? Auch für alleiniges Sorgerecht, Vaterschaft anerkennen, gemeinsames Sorgerecht, gemeinschaftliches Sorgerecht und Umgangsrecht, Umgangsregelung sind wir Ihr Profi

- gemeinsames Sorgerecht, gemeinschaftliches Sorgerecht

- alleiniges Sorgerecht, Vaterschaft anerkennen

- Sorgerecht

- Umgangsrecht, Umgangsregelung

Rechtsanwalt von Sorgerechte gesucht?

Bennewitzer Rechtsanwalt aus dem Kreis 03425 gesucht?

Haben Sie eine Frage? – Kontaktieren Sie uns telefonisch direkt für Bennewitz – Telefon: 03425 215-241

Unsere Angebote in Bennewitz (Sachsen)

- Familienrechte in 04828 Bennewitz Deuben, Grubnitz, Schmölen, Altenbach, Nepperwitz, Zeititz, Leulitz, Pausitz, Bach, Neuweißenborn, Rothersdorf

- Gütertrennung im Großraum 04828, , /

- Scheidung für 04828 Bennewitz – Altenbach, Schmölen, Rothersdorf, Leulitz, Grubnitz, Deuben oder Pausitz, Neuweißenborn, Nepperwitz

- Sorgerecht BNA, GHA, GRM, L, MTL, WUR

- Kindesunterhalt in Sachsen

- Familienrecht aus Bennewitz, Borsdorf, Eilenburg, Naunhof, Wurzen, Machern, Brandis oder Thallwitz, Trebsen (Mulde), Lossatal